Table of Contents

Best Gold Storage Options for 2025 - Where to Store Your Bullion

If you’re one of the countless people looking to purchase gold in an IRA right now, you’re going to want to read this. Because we’re going to cover everything you need to know about gold IRA storage below.

In the next few minutes you will learn:

- Why the IRS requires that you store precious metals in an IRA at a 3rd party depository

- How home storage gold IRAs are illegal

- IRS approved depository options in Delaware, Nevada, Utah, New York, California

- The 2 types of gold IRA storage fee structures and which is better

- The difference between segregated and commingled storage

- And much more…

IRS Rules on Gold IRA Storage

The Tax Payer Relief Act of 1997 permits certain precious metals to be held within retirement accounts. Per the Internal Revenue Code Section 408n, the precious metals must be stored at a bank or with a 3rd party IRS approved non bank trustee. Your self directed IRA custodian subcontracts this service to depositories per IRS regulations.

Home Storage Gold IRA Myth

The idea of a home storage gold IRA may sound appealing to many. And in recent years home storage IRAs were promoted heavily. They first came about with the introduction of what’s called a checkbook IRA. The idea was that you’d set up a self directed IRA that would own an LLC as it’s sole asset. That LLC would then purchase gold, that you would store at home. Hence home storage IRA. American Eagle coins were the only precious metals permitted with this set up.

But in recent years the Internal Revenue Service has clarified its’ position on the checkbook IRA and the home storage aspect. The IRS deems home storage gold IRAs could be a prohibited transaction because of rules on self dealing. If they become aware of it your complete retirement account could be considered a distribution per IRS regulations and you could lose the tax deferred status of your retirement plan.

Gold IRA Storage Depository Options

The first two precious metals IRA storage options below are approved with Strata Trust. Equity Trust are approved with the Delaware Depository as well, along with the subsequent options. Strata and Equity are the most popular self directed IRA custodians offering precious metals IRAs. They are also the only two firms that offer a flat rate fee structure for gold IRAs.

Delaware Depository

The Delaware Depository (DDSC) is the most commonly used depository for precious metal IRA accounts. They’re a privately held company founded in 1999. They have locations in both Wilmington, Delaware and Boulder City, Nevada.

DDSC is licensed by the CME Group (COMEX) and ICE Futures for physical gold and silver security.

They offer specialized precious metals custody for self directed IRA custodians, individual investors, investment banks, brokerage firms, refiners, manufactures, coin dealers and commodity trading houses.

DDSC maintains comprehensive inventory controls and detailed reporting systems. Their Class 3 vaults feature state of the art security systems. And all bullion is held off balance sheet and is fully allocated. All precious metals are insured by a $1 billion all risk insurance policy with Lloyds of London.

DDSC offers commingled storage for accounts holding gold, silver, platinum and palladium. Or segregated storage for accounts that only hold physical gold. Both are for a flat rate.

The Certified Gold Exchange (CGE) and its’ trading partners also maintain accounts at DDSC. So if you’re buying, selling or trading within your self directed IRAs, and your precious metals are stored at DDSC, shipping is free of charge.

Texas Precious Metals Depository

The Texas Precious Metals Depository (TPMD), is located in Shiner, Texas. TPMD is a subsidiary of Kaspar Companies Inc., a privately owned, fifth generation family owned Texas company.

TPMD offers segregated precious metals storage for retirement accounts and individual account holders. All gold, silver, platinum and palladium bullion remain the property of the account owner and are insured by Lloyds of London all risk policy.

Their state of the art facilities feature Class 2 vaults, video recording and a designated security team with swat and military combat experience. All precious metals are audited annually by ADKF, a San Antonio, Texas firm.

TPMD only offers segregated storage to hold precious metals for a flat rate of $175 per year.

Brinks

Brinks, founded in 1859, is a publicly owned cash and valuables management company operating in 52 countries.

Brinks offers state of the art vaulting facilities for precious metals IRA accounts and personally owned assets. They have locations in Los Angeles, New York and Salt Lake City.

Brinks offers commingled storage for IRA accounts holding gold and other precious metals. And segregated storage for accounts that only hold physical gold. Both options are for a flat rate. But in our experience Brinks has subpar customer service and their processing times are longer than usual. We would not recommend using them to store precious metal investments.

International Depository Services

International Depository Services (IDS) is a privately owned company founded in 2010. IDS offers precious metal storage solutions for personally owned assets, institutional investors, mining operations, sovereign mints, refineries, hedge funds, family offices, pension funds, financial institutions, bullion dealers and retirement accounts.

IDS has depositories located in Wilmington, Delaware, Dallas, Texas and Ontario, Canada. Although for gold IRAs clients can only hold precious metals in either Delaware or Texas.

IDS is accredited with The Commodities Exchange Inc. (COMEX) and Intercontinental Exchange Futures U.S. (ICE)

They provide state of the art security using multi redundant systems while utilizing Class 3 vaults for physical precious metals storage. All assets are held off IDS’s balance sheet and are insured by a Lloyds of London all risk insurance policy.

IDS only offers segregated storage precious metals IRAs for a $150 per year.

AM Global Logistics

AM Global Logistics (AMGL) a publicly traded company was founded in 2015. Along with their security partner, Loomis International, they offer depository services for gold IRAs, personal account holders and businesses. AMGL is UL certified and maintains an all risk insurance policy. They have locations in both Las Vegas, Nevada and Dallas, Texas.

They offer commingled precious metals IRA storage for a flat rate or segregated based on the value of your IRA account.

Gold IRA Storage Fee Structures

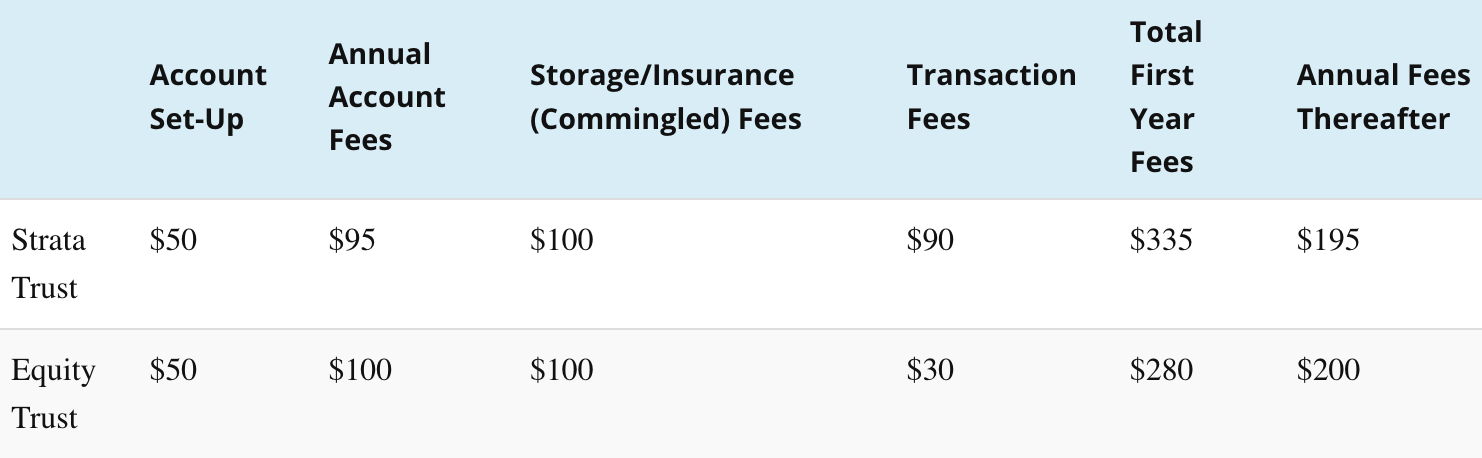

You gold IRA custodian is going to have one of two basic fee structures to store precious metals. Either a flat rate or a sliding scale based on the value of your tangible assets.

The only self directed IRA custodians that have a flat rate to store gold, silver platinum and palladium are Strata Trust and Equity Trust.

Below is a screenshot of their respective fees to store your physical precious metals in a commingled IRA account.

The sliding scale precious metals fee structure is based on the value of your tangible assets. There will typically be a minimum gold IRA storage fee of around $100. But if your retirement assets reach a certain threshold you’re charged a percentage of the value of your IRA account. CGE suggests you use a IRA custodian that offers a flat rate to store your precious metal so you don’t needlessly pay higher fees.

Segregated and Commingled Gold IRA Storage Options

Depending on where you choose to store your precious metal, you’ll have the option of either segregated or commingled storage for your gold IRA. However, both Texas Precious Metals Depository and International Depository Services both only offer segregated storage at an increased cost or $175 and $150 respectively. Below is an explanation and differences between the two options.

Segregated Gold IRA Storage

Separated gold storage, also known as segregated gold storage, refers to a method of storing gold or other precious metals in which each owner’s assets are kept separately and distinctly identified. In this arrangement, individual gold bars, coins, or other forms of precious metals are stored in dedicated storage spaces or containers, and each item is clearly marked or tagged with the owner’s information.

The primary advantage of segregated gold storage is the assurance of clear ownership and easy identification of one’s specific assets. This approach provides peace of mind for investors who want to ensure that the gold they own is readily accessible and has not been mixed with the assets of other individuals or entities. It also makes it easier to account for and track one’s holdings.

Segregated storage typically comes at a higher cost compared to commingled storage, as it involves additional logistics and security measures to maintain the separation of assets. However, for investors who value the transparency and security of knowing exactly which gold assets belong to them, segregated gold storage is a preferred option.

Commingled Gold IRA Storage

Commingled gold storage refers to a situation where gold or other precious metals owned by multiple individuals or entities are stored together in a shared storage facility or repository. In this setup, the individual ownership of specific gold bars or coins is not physically separated or segregated. Instead, all the gold items are stored in a common pool or vault, making it challenging to distinguish one owner’s assets from another’s based on the physical items themselves.

This approach is often used in scenarios where multiple investors want to pool their resources for storage and security purposes, potentially reducing storage costs. However, it can pose some challenges when it comes to tracking individual ownership and ensuring that specific gold holdings are readily available for withdrawal or transfer.

Commingled gold storage contrasts with segregated storage, where each owner’s gold assets are stored separately and distinctly identified. Segregated storage provides a clearer separation of ownership and can be beneficial for investors who want to ensure the specific gold they own is readily accessible and identifiable.

Gold Storage IRA FAQs

Can I store my gold bullion IRA at home?

Can I visit the depository and see my gold coins?

Yes. If you would like to make an appointment to visit the depository and see your precious metal, you are able to.

Why won’t the depository give me information about my precious metals investments?

If you contact the depository directly they’ll refer you to your IRA custodian. That’s because your gold investments are in an IRA account. The depository is subcontracted by the custodian to store your precious metal, so your relationship is with them. If you were to set up a personal account at the depository and use non qualified (not IRA) funds your relationship would be directly with them.

If I want to buy gold and other precious metals with personal assets can I store them at the same depository where my individual retirement account is held?

Yes. If you would like to use other funds that are not in the form of an individual retirement account, you can establish a personal account with the depository. To do so, you’d simple complete their application and they’d have your new account set up within 48 hours. You can then hold physical gold and other precious metals outside of a retirement account.

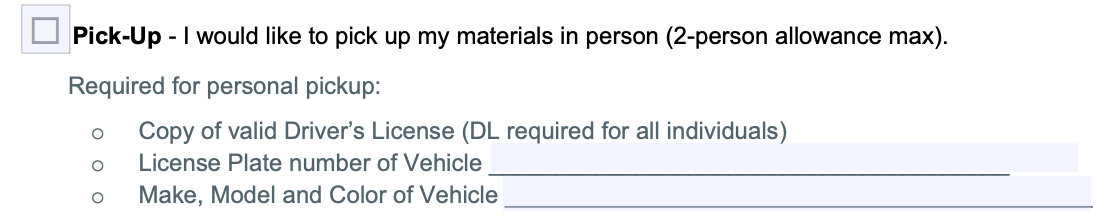

Can I take possession of the precious in my IRA account directly from the depository in the event of an emergency?

Yes. If you would like to take a distribution from your IRA, you are able to pick the metal up directly from the depository rather than have it mailed to you. Below is a screenshot from Strata’s Distribution Request form outlining the information required to do so.

Contact our Gold IRA Storage experts today at 800-300-0715.

Written by Gold IRA Experts Pat Collins and John Halloran

Avoid These 10 Gold IRA Scams.

DEALERS USE ON YOU